Even after slipping to a 6-month price bottom a little over a week ago, BTC’s network growth has continued at a remarkable rate.

- Experts believe that BTC needs to hold on to its AUD$52,500 (US$37,000) resistance to regain any sort of bullish support.

- Bitcoin’s relative strength indicator (RSI) suggests that the asset is currently “oversold” and that more investors could soon make their way into the market.

- Meta recently filed documents with Brazilian trademark authorities to develop a suite of Bitcoin-related products including wallets, a trading platform and more.

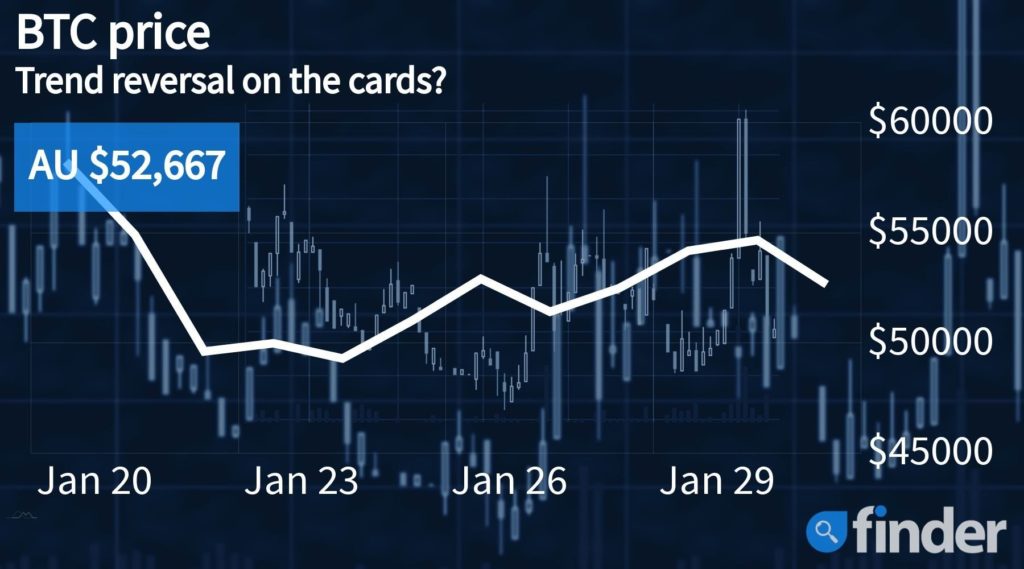

After seemingly having broken out of its bearish price trap by scaling up to a relative high of US$38,200 (AUD$54,400), Bitcoin, the world’s largest cryptocurrency by market capitalization, has proceeded to correct once again, dipping by a little over 3% over the last 24 hours. At press time, the flagship is trading at a price point of AUD$52,400.

Analysts such as Michaël van de Poppe noted that the surge was largely driven without any sort of “traditional market guidance” and that over the coming few weeks, the digital asset could continue to be faced with monetary turbulence, especially if BTC fails to hold tight to its all-important AUD$52,500 (US$37,000) price resistance.

Technical on-chain data suggests that a positive breakout may be on the cards for Bitcoin since its RSI has continued to hover in the “oversold” region for many weeks running, with the metric sitting at its highest levels since March 2020 – a time when the market was in full panic mode due to the onset of the coronavirus pandemic.

Bitcoin hashrate continues to climb despite waning price action

Despite hitting a 6-month low on 21 January, Bitcoin’s network has continued to grow from strength to strength, with its hash rate recently scaling up to an all-time high of 26.643 trillion — registering an average value of 190.71 exahash per second (EH/s).

In fact, most industry experts are confident that this trend will continue into the future as investors continue to see the damaging effects of the Fed’s lax monetary policies that have been in place over the last couple of years.

On the subject, Darin Feinstein, co-founder of blockchain infrastructure provider Core Scientific, pointed out that following the great Chinese miner exodus of 2021, Bitcoin’s network capacity proceeded to grow by a whopping 200%, adding:

“The Bitcoin network 1 year ago was approximately 143 EH/s. Following the mining ban in China, the network fell to 63 EH/s. Today, the hash rate has grown to approximately 198 EH/s. This recent increase represents … 130 EH of new hosting infrastructure and primarily new generation hardware deployment … in geographic regions that use far cleaner energy than the energy used in China.”