Today, approximately 31% of the world is unbanked, meaning that nearly two-billion people are denied access to financial products and services because they do not meet traditional qualification standards.

The reliance on traditional data as a verification method disproportionately affects those in developing countries and widens the disparity between the wealthy and the impoverished.

As a result, these people, who are often the most vulnerable to economic shocks and the most in need of financial relief, are denied the ability to apply for loans or mortgages, or even create bank accounts.

While the situation may seem dire, solutions are on the horizon as financial inclusion is on the rise, starting with El Salvador – and thanks to Bitcoin.

Before jumping into how Bitcoin banks the un-banked, let’s look at what banking is, and why so many people do not qualify for traditional financial services.

The Benefits of Banking

Banking provides billions of people with access to financial tools and services, from safe custodianship of money (a.k.a. saving) to lending tools like loans and mortgages.

By efficiently allocating funds between savers and borrowers, banks play an important role in reducing the cost of information for customers and help mitigate risks associated with borrowing and lending through tools like collateralization and customer due diligence.

Without access to banks, those living in the traditional financial world are denied safe custodianship of money, yields from returns on interest, the ability to borrow money on sound terms, and access to much of the global economy.

As a result, these unbanked individuals are exposed to more risk and potentially unfair terms or disproportionate costs of saving and borrowing and are kept from reaching their full growth potential.

Unfortunately, inequality is kept alive because the tools used by banks to conduct consumer due diligence and carryout the approval process for access to banking services are often unfair to vulnerable demographics that do not have the ability to store their data on traditional means.

The Problem with Antiquated Qualification Standards

Banking follows the conventions of an old and antiquated system and relies on traditional data sources to verify customer identity and credit worthiness with tools like credit bureaus.

The main issue in qualification is that many people who live in the developing world, and are detached from sound institutions and stable governments, lack proper identification documents, and do not have the ability to store their data via traditional means.

Without proper identification documents, individuals cannot create bank accounts and establish formal credit records, which are another common approval requirement, and are subsequently stuck in a feedback loop of financial exclusion.

These individuals typically have some form of identification documentation and a multitude of ways to verify identity and credit that are foreign to traditional bank standards, and thus not accepted as a means of approval.

Of the nearly two-billion people that are unbanked globally, two-thirds own a mobile phone and have a record of both phone and social media use with multiple sources of identity verification.

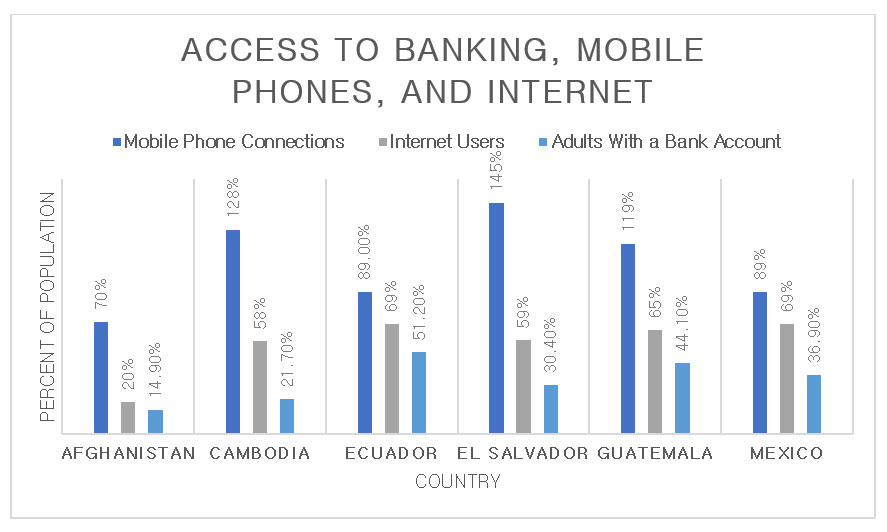

In countries with the highest level of un-banked populations, it isn’t uncommon for more people to have mobile phones and internet access than access to banks, and in some cases, for mobile phone connections to outnumber the population as individuals have more than one mobile phone.

Source: Data Reportal, The Global FinDex Database

In addition to mobile phone connections, smart phone usage has reached an all-time high and it is estimated that half of all mobile phone connections are smart phone users.

Allowing for unconventional methods of verification could alleviate many of the constraints posed by strict approval requirements.

The Bitcoin network and financial products built on top of it allow for this process to play out, and adoption on a country-by-country scale means that the answer to this problem might not be as far into the future as anticipated.

The Solution: Bitcoin Puts a Bank in Your Back Pocket

Bitcoin doesn’t have use requirements or rely on traditional means of verification because there is no approval needed to use Bitcoin.

The Bitcoin network operates on a decentralized, distributed, and immutable ledger with no central authority or barrier to entry.

Because of this, anyone who has a smart-phone and access to the internet can purchase Bitcoin and transact on the network anywhere in the world.

The Bitcoin network not only provides safe storage and easy transactability of money, but also provides a purchasing history and public credit record by writing transactions to an immutable (unchangeable) ledger and recording the value of accounts publicly.

As such, the network provides individuals with identity verification, a public record to establish credit history, carries no credit risk, has no counter party risk, no human error risk, and cannot be censored, rescinded, duplicated, or debased.

In addition, those who transact on the Bitcoin network have access to inclusive financial services provided on the network as well as private property rights (for the first time) since Bitcoin is non-confiscatible and transferable cross-border.

El Salvador is Banking the Un-Banked

Mass country adoption is just around the corner and is happening on a small-scale present day.

On September 7th, 2021, El Salvador became the first nation in the world to recognize Bitcoin as legal tender. In doing so, El Salvador has made great strides in banking their un-banked population.

Over the past 40 years, El Salvador has only managed to bank 30% of their population, which accounts for approximately two million of their citizens.

As a result of Bitcoin adoption, within the past three-months, El Salvador has banked three-million people with Chivo Bitcoin wallets, according to President Bukele.

This number undershoots the total number of people banked as the Chivo wallet is just one of many wallets used by El Salvadorians. Still, it brings the total number of Salvadorians banked from 30% to 46%.

Salvadorians who utilize the Bitcoin network now have access to all benefits of the network without risk of government seizure or debasement.

Beyond the borders of El Salvador, Bukele hopes that Bitcoin and Chivo wallets will help citizens abroad send remittances home to family, who previously relied on slow moving legacy systems or physical cash or checks to make transfers home.

According to a report by NBC, 50 Chivo specific Bitcoin ATMs to send remittances have been installed across the United States, from Los Angeles to Atlanta, and according to President Bukele, nearly $2 million is being sent via Chivo daily. The Chivo specific ATMs come in addition to 48,000 Bitcoin ATMs that exist nationally.

Users have reported that sending remittances home to El Salvador via Chivo save them up to $18, as bank fees can be costly, and in some cases not an option when access to financial services is limited.

Chivo wallets also make payments easier, according to local businesses, who note that ease of transactions has greatly benefited small entrepreneurs.

A Financially Inclusive Future

Bitcoin puts a bank in your back pocket by giving you a digital wallet that holds the keys to pure private property and sound money that cannot be seized or debased by governments.

In addition, Bitcoin erases the problems associated with traditional banking qualification standards by providing unique addresses for identification purposes and established credit records on the Bitcoin network’s immutable ledger.

This new technology ensures that our most vulnerable populations have access to inclusive financial services and can participate in the global economy which will be of utmost importance in curtailing wealth disparities in the future.